Better than a debit card, ZAAP switches pocket money to prepaid

As the traditional piggy bank is relegated to the toy box, a new generation of parents is taking up the challenge of teaching children the importance of saving their pocket money with a new cashless tool.

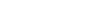

Designed for today’s families, ZAAP is a new way to manage pocket money that is being welcomed by parents who want their children to learn the basics of money management while they stay in control of their children’s spending.

A cashless alternative for pocket money, the recently launched ZAAP app features cutting edge technology to be Australia’s low-cost, customisable prepaid Mastercard for young people. Available as a design-your-own card and a wearable band, it is changing the way children learn about saving and spending.

10 reasons why ZAAP is better than a debit card or savings account:

- ZAAP is the leading-edge digital pocket money tool. It’s easy to use and you can set savings goals for the things you really want

- Convenient. Parents can transfer funds to the card at any time or on a set and forget basis.

- ZAAP app is supported with parent and child portals. Parents retain control with full visibility of their child’s spending. Whilst children can see their account balance, transaction history and set savings goals.

- Teaches children financial skills in managing their pocket money and spending

- Parents can manage multiple ZAAP accounts for their children from one app

- Children can only spend what is loaded on the Card so they can’t get into debt

- 50 card designs to choose from or customisable card which can be designed with your child’s favourite photo

- Wearable band which is the only wearable of its kind for children. Plus, it comes with the Keeper which can be attached to an existing watch or fitness band for ultimate convenience

- ZAAP is built with Tap & Go functionality and can be used anywhere that accepts Mastercard in over 37 million retailers, instore and online

- With no application required, ZAAP is much easier to get than a debit card

ZAAP is the alternative to a savings account

Pocket money used to start with a piggy bank and a savings account which was once the best way to help teach children about saving their pocket money.

Everyone needs a bank account and starting children young on their savings journey was an important step in having them learn how to save and manage money for the future.

Today’s constantly evolving technology is pushing the boundaries of a new generation of savers and introducing new ways to learn about money management.

Every parent knows that children have their own needs and wants – and without doubt all of them cost money. Helping your child understand how money is earned, spent and saved through pocket money is one of the critical tasks for parents as their children grow.

Starting a new tradition with ZAAP

The traditional way to introduce your child to saving was to open a savings account where they could see their savings grow – provided they kept contributing regularly and didn’t withdraw.

Savings accounts from banks, while they usually include no account keeping fees and a higher interest than regular accounts, each has various conditions that may include age restrictions and a savings limit. Do your research on which account best suits you before committing to one for your child.

Safe and secure saving and spending with ZAAP

ZAAP is more than a savings account – it provides a tool for parents to teach children good spending and saving habits in a safe and controlled environment. The app features reinforce positive behaviours with children being able to view their balance and transactions as well as set and track multiple savings goals.

You can find out more about the advantages of ZAAP and the many benefits for you and your family here. Plus, for a limited time only, you can order the ZAAP Pocket Money Mastercard with 50 designs to choose from for FREE (RRP $9.95).